Multi-residential ownership in the metropolitan south can be a hedge against losses consequent on the ebb of work from the northern resource centres.

By Shawn Selway

Published August 15, 2016

This is the first part of a three-part series. You can read part 2, part 3.

The road to stability? Highway 389 from Labrador City to Baie Comeau.

If you were at the wheel of a Real Estate Investment Trust (REIT) whose portfolio was based in towns built on resource extraction, and if a decline in basic commodity prices was followed by a steep drop in the value of crude oil, what would you do?

If you were running Northern Properties, whose predicament I have just described, you would try to calm the proverbial "nervous shareholders" while hurriedly seeking some means of diversifying your holdings. To do so, you would have to look south, to the Quebec and Ontario markets, where conditions are different.

In the North and West, the price of iron and diamonds, potash and oil, along with the housing needs of short contract government functionaries, drives the rental market. Here in Southern Ontario, it is the widening gap between income and the cost of home ownership which sustains the demand for accommodation in "multi-family" buildings.

Accordingly, multi-residential ownership in the metropolitan south can be a hedge against losses consequent on the ebb of work from the northern resource centres.

But there is a catch. Because we have rent controls in Ontario, which include an annually adjusted maximum increase - hereafter, the "guideline increase" -- landlords wishing to raise their tenants' rents by more than two percent this year (a rate set annually by the province to offset inflation, which landlords say is not enough) must apply to the Landlord and Tenant Board for authorization to do so.

And if you are Northview, as Northern Properties diversified now calls itself, after absorbing a batch of southern buildings, you certainly are going to apply, because you have debt to pay down and because you have promised unit-holders that you will do so. It forms part of your "Strategic Value Creation" plan.

However loosely they may be interpreted, the rules governing what is commonly called an AGI (an Above Guideline Increase) are clear and detailed.

The landlord must be able to show that either taxes or utility charges have taken a sudden extraordinary leap upward, or that capital expenditures have been made, in one or another of several well-defined categories, and only in these. A claim cannot be based on operating expenses nor on merely cosmetic alterations.

This, in any case, is the story on paper. The upshot is that, in order to obtain an order from the Board obliging your tenants to pay anything over inflation, you must slap up some paint, change out the lights or the plumbing fixtures or whatever, have the work checked by a third party consultant, and pay everyone off.

Only then can you contact the lawyers and instruct them to apply to have the costs downloaded to the people enjoying the presumed benefits of the presumed improvements.

So it was that, with documents duly filed and tenants confusingly apprised of the particulars and notified of their right to have a say in the matter, the Landlord and Tenant Board recently came to consider the applications for AGIs at two downtown high-rise buildings, on Market Street just west of the Colosseum between Bay and Queen.

(Northview Real Estate Investment Trust, the owner and manager of the buildings, has a contiguous property, 155 Market Street, but this has already been "repositioned" as the phrase is, by a previous owner.)

The proceedings unfolded in a sixth floor hearing room in the Fairclough Building across from Jackson Square.

Championing the claims of the owner, the shareholders and the assorted managers, contractors and consultants who have their forks in the pie, was Paul Cappa, a paralegal in the employ of Cohen Highley, a London law firm. Cohen Highley is very big in landlord and tenant matters.

Cappa and a Cohen Highley partner, Joe Hoffer, were active on the Landlord and Tenant Committee and the Rent Control Committee of the Federation of Rental housing Providers of Ontario (FRPO) when those committees still existed, and Hoffer produces an extended Landlord Reference page for his firm's site.

Representing the tenants in their slightly successful attempts to curb the sought-for increase were Steve Dylag (160 Market) and Raymond Pasche and his partner Harinder (150 Market). Cappa was accompanied by two gentlemen whose affiliation I never learned.

Also attending for the tenants was Brendan Jowett, a lawyer with the Hamilton Community Legal clinic, who acted as duty counsel.

Looking south from the Landlord and Tenant Board hearing rooms in the Fairclough Building.

First up was 160 Market. Shortly before ten o'clock, the interested parties congregated in the hall outside the hearing room, where they were asked to sign in before entering.

Enrolment was supervised by a couple of security guards of the short, beefy type that are employed where the need for a little man-handling is anticipated - a clue that the frustration level could run high here.

The view to the south was grand. You saw that the MacNab transit hub terminal directly below had a green roof, and realized just how fond our foremothers and fathers were of raising steeples.

Off toward the mountain, a crowd of towers and slabs stretches across Corktown and Durand, the legacy of the apartment-building boom that began with the revision, in the fall of 1964, of the zoning bylaw to remove a six story height restriction in the central city.

Controller Jack MacDonald told the Spectator (Nov. 25, 1964) that Hamilton would be needing about 1,500 "family living units" a year for the next twenty years, and that "We can't afford to keep on pushing services out to the suburbs."

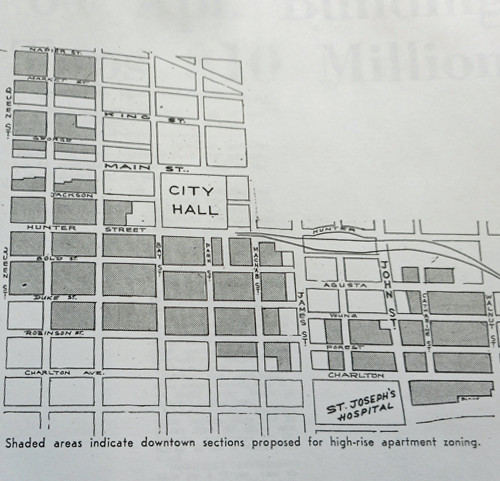

In 1964, amid the usual fretting and grumbling that we were falling behind other large cities, height restrictions were removed from forty-six blocks in the core. Source: Hamilton Spectator, Nov. 25, 1964.

By and by there were about twenty in the room, not all tenants and not all from 160, which is a 168 unit building. Dylag, with his binder of argument and evidence, was sitting at a table down front, across from another evidently meant for the "the applicant".

His strategy was to question the nature of the so-called capital expenses (capex), most of which he thought were nothing of the sort, but merely cosmetic and so not allowed in a capex claim. As Dylag saw it, the money that had gone into painting the balcony railings brown would have been better spent on redoing his apartment - an eventuality which is extremely unlikely under the current arrangements. In any case, he couldn't understand how painting the brick or the balcony railings would qualify as a capital expense within the definition of the Residential Tenancies Act, to wit:

(a) it is necessary to protect or restore the physical integrity of the residential complex or part of it;

(b) it is necessary to comply with subsection 20 (1) [maintaining in good repair and complying with health etc. standards] or clauses 161 (a) to (e) [having to do with mobile homes];

(c) it is necessary to maintain the provision of a plumbing, heating, mechanical, electrical, ventilation or air conditioning system;

(d) it provides access for persons with disabilities;

(e) it promotes energy or water conservation; or

(f) it maintains or improves the security of the residential complex or part of it.

Painting balconies would appear to be maintenance, painting the outside of the building was surely cosmetic (though tuck pointing the joints is not), and replacing the toilets was simply unnecessary.

In practice, however, as we learned during the course of the day, the language of the Act and the Regulations is interpreted by the Board to mean "pretty much anything that affects everyone in the building."

160 Market. Exterior paint claimed as capex June 2016.

Beyond the tables was a desk, somewhat elevated, and beyond that an inner room or two, whence came a woman who introduced herself as Melinda Jameson and explained that she was a dispute resolution officer with the Board.

Her role was to mediate a settlement in order to avoid a full hearing, if the parties were of a mind to negotiate - a possibility previously unknown to the respondents, who had been preparing for a hearing before an adjudicator who would listen to both sides and then decide what was fair.

Jameson went on to recapitulate, for the benefit of anyone who was not yet up to speed, the distinction between a Guideline Increase, which is an inflation-shadowing increase based on the Consumer Price Index; and an AGI request, which is based on extraordinary jumps in taxes or the cost of gas or power, or on capital expenditures.

In this particular case, the expenditures were for work on the building envelope, upgrades in the boiler room, and renewal of the plumbing fixtures.

Merely cosmetic changes could not be counted as capex. On the other hand, Jameson said, she had seen the repainting of a building with the company colours successfully claimed. The benefit conferred by a capex must last at least five years, and this is termed its "useful life", at the end of which the rent may be reduced.

Today's application affected 117 of the 168 units in the building, but not equally. For eighty units, an increase of 4.2 percent over two years was sought; for the rest, only 1.47. (The difference had to do with when a tenant had moved in, and how long it had been since the last increase.)

The maximum permissible AGI in any twelve month period is three percent. An AGI may be denied if there is a "deficiency" in the building at the time of the hearing of the application, but a municipal work-order requiring the correction of the deficiency must be shown to prove that it exists.

At this point, Jowett, the lawyer from the legal clinic, turned to the room and offered his opinion: the Board was designed to favour the landlord. The tenant's best option for improving conditions in their building was through generalized N-6's, that is, coordinated individual requests.

Jameson asked if there was a desire to negotiate. The room was polled and the answer was yes, so she went off to put the same question to Mr. Cappa.

While she was out, there was a general discussion leading to a consensus that Dylag should bargain to have the cost of the external paint, clearly not a "structural" item, removed from the claim, as well as the cost for the low-flow toilets, since these did not in fact save water as they required more flushing than the old fixtures. Also, they were low and badly placed and caused difficulties for wheelchair bound tenants, two of whom were there to raise accessibility issues.

It was suggested that Dylag start by proposing a one percent increase, and go as high as 1.8. Beyond that, a hearing would be preferable to continued negotiation.

Jameson returned to say that Cappa et al were agreeable to talking. She was asked if it were possible for an individual to have a separate hearing. Well, no. The question was puzzling, since it was hardly conceivable that someone would argue that they should not be required to pay for the same improvements as everyone else (e.g. hot water from the new boilers).

It emerged, however, that this fellow believed that he could make a better case than Dyalg, and indeed, felt that the others were in effect robbing him of his right to defend himself properly at a proper hearing.

155, 160, and 150 Market Street.

Jameson took Dylag, Jowett, and two other tenants proposed by the room away to join the applicants somewhere offstage. The rest of us stood up to stretch our legs and began chatting with our neighbours.

The mood was one of wry pessimism, the feeling that comes over you when you see that you are unlikely to win but your self-respect won't allow you to concede without a struggle.

"Big companies, eh? They just grind you down," said the guy sitting behind me, who nonetheless had shown up, and who stayed for the entire morning.

The tenants' team was gone for forty minutes. When they returned, the non-participants were sent out while the tenants discussed what had transpired. Cappa had agreed to subtract most of the claim for plumbing, which was about eighteen thousand dollars, and to knock ten thousand off the building envelope claim.

(Some days later, when I was going through the Act and its companion regulations and guidelines, I learned that in fact water conservation measures, like low-flow toilets, are allowable over any objection that the existing fixture is still in good condition and does not need replacing, simply because it is a conservation measure. (Sections 7 and 8). Cappa's yielding on this point was a strictly tactical concession.)

The outcome was that 160 Market settled on a 3.8 percent increase, 1.9 percent a year over two years, down from the 4.6 the landlord wanted.

In addition, the landlord undertook to conduct a whole-building campaign of pest control, if needed, rather than putter about one unit at a time, which scatters but does not eliminate the pests; and also to examine the accessibility issues, particularly at the main entrance.

Jameson fetched in Cappa (grey suit) and his sidekicks (stylish checked shirts) who took their place in the hearing room, and then brought in the adjudicator, Michael Soo, who took note of the specifics for inclusion in his order, due within sixty days, and adjourned. We went for lunch, slightly confused and mildly unhappy, except for Mr. Independent, who was very unhappy, insisting that an 0.8 decrease was simply not worth having.

A week or so later, Steve Dylag dropped by the Board offices with a question: missing from the AGI application had been a quantity of work which was done in the so-called "common areas." Was there a second application on the way? Yes indeed. It had been filed on April 7, 2016 and the claim was in the amount of $407,729.78 for "common areas" i.e. lobby and corridors. This second hearing is set for Sept 28.

The Real Estate Investment trust is a variation on the familiar mutual fund, so popular as an RRSP stuffer. Instead of buying into a bundle of stocks, the REIT unit-holder takes a piece of a real-estate portfolio in one or another flavour: apartment, office, retail, hotel, or whatever.

This proposition is attractive to smaller investors who have a fondness for land, since it has an almost unstoppable tendency to appreciate no matter what is on it, but no appetite for the headaches that come with full ownership of an "income property" - a house or two or three, or a small apartment building, say. Otherwise, the holding is similar.

When the tenants of the 278 units at 150 and 160 Market Street (and 25,000 other units across the country) pay their rent, most of the cash flows through Northview and, after expenses, straight on to the trust's unit holders, on a monthly basis.

They log it as income and are taxed accordingly or, if they prefer, they can leave the money in the trust by using it to purchase more shares at a discount.

If you ever want out, it is just a matter of selling your shares, which trade like any on the exchange. (Except in the unlikely event of a peasant uprising, such as occurred in England's Brexit vote, which caused commercial property REIT managers to freeze withdrawals. For the investor's own good of course, as well as management's.)

Northview Apartment REIT is a publicly-traded appendage of a hydra called Starlight Investments, and is the outcome of maneuverings which began in April, 2012 when Starlight, along with three partners, entered a deal with the publicly-traded Trans Globe REIT to disassemble Trans Globe, parcel out the pieces among themselves, and take the whole works private.

The month before, the leading figures in Starlight, CEO Daniel Drimmer and CFO Martin Liddell, had filed with the TSX and the regulator the prospectus of an entity called WAND Capital Corporation (a "capital pool company").

The purpose of WAND was to pick up a little walking-around money (about three hundred and seventy five thousand) to do the tire-kicking on an acquisition that would meet the stock exchange requirements for a listing. That initial purchase, announced on June 5, turned out to be a 72 unit apartment building in Guelph, and WAND turned into True North Apartment REIT.

The new REIT immediately bought two more rather modest properties in Ontario, and then, at the end of the month, 1,528 units in Ville Saint-Laurent, north of the Boulevard Metropolitaine in Montreal.

This bagatelle was financed in part by a share offering meant to raise between 42 and 48 million dollars from external investors.

The Acquisition Properties consist of two low-rise complexes on nearly 30 acres. . . The 127 three-storey detached multi-family apartment buildings were constructed circa 1948-1952 and have been well maintained and managed with approximately $5 million spent over the last three years on building fundamentals, such as balconies, roofs and electrical upgrades...

The property is within walking distance to the Metro, with access to the subway and regional bus hubs, schools (French and English) and amenities such as grocery stores, boutiques, community centres and parks. . .

From this distance, two parcels totalling thirty acres just off the end of a subway line and occupied by seventy-year-old three story buildings would also seem a prime candidate for intensification at some near date.

A portion of True North's Saint Laurent acquisition. Source: Google Maps.

As for the immediate future, the press release announcing the Montreal acquisition also spelled out the close ties between Starlight and True North, which are controlled by the same people.

...Starlight has advised the REIT that its current intention is to offer to sell to the REIT additional rental properties it has ownership interest in, over the next few years. Starlight has developed a strong position in key geographic markets with deep relationships with local property managers. Starlight will focus on enhancing the value of the REIT's assets to maximize long-term Unit value through active management strategies.

Over the next three years, Starlight kept moving properties into True North, presumably because the REIT gives Starlight owners and managers access to the capital of small investors and perhaps some institutions, thereby leveraging or freeing up their own for other ventures and continued expansion.

All of this paper churning is remote from the peeling paint and rusting balcony railings of the high-rises of the Hammer, and someone must turn their mind also to those problems and how to fix them - or more precisely, how to make them eligible for a capex claim under the Residential Tenancies Act - and how to extract payment of that claim from the tenants.

These are the "active management strategies" on which the entire, vastly extended enterprise relies. In the case of 150 and 160 Market, the invoices presented with the capex claim were from Pro-Bel Enteprises, who provided anchoring for exterior scaffolding systems; De-Cor Building Restoration, who did the painting, and other outfits that supplied plumbing and boiler equipment.

Project management and oversight was by Enerplan Building Consultants, who no doubt know what is expected and what is not expected of them in terms of quality control on a job whose purpose is an AGI claim that will increase cash flow. Handling of the resulting claim, as noted, was by Cohen Highley, whose RTA specialist, Joe Hoffer, describes the firm's services as follows:

It is not uncommon for buildings to contain long term tenants paying "below market" rent. Cohen Highley has had extensive success at the Landlord & Tenant Board in structuring building rehabilitation scenarios in which

Capital investment is made to the building & units

The Landlord can apply to increase the rent by up to 9% on those below market units

Cohen Highley can help landlords stickhandle through the legal process while ensuring regulatory compliance with maintenance & repair obligations; avoidance of risk of rent abatements while work is underway; & achievable increases in revenue for long term recovery of capital investment & immediate increases in Net Operating Income.

Northern Property holdings.

Meanwhile Northern Properties, a country cousin among REITs, continued to plod along doing what had worked for them, providing working-class housing in the hinterland.

We offer furnished and unfurnished apartment rental homes in most of our areas with a flexible lease term to assist contractors and corporations working in towns and cities that cater to oil, natural gas, diamonds, forestry products or agriculture. The communities in which we invest are filled with people who produce the commodities for which Canada is famous.

It brings a tear to me eye, as they say on the island. In fact, this outfit was so old-school that they actually moved into construction and began fixing capital in buildings.

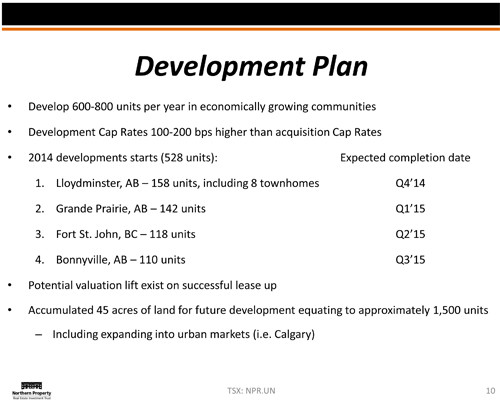

Food, fuel, and fibre. Above, the list of Northern Properties' investments in the back country, where people are still engaged in basic production. Lloydminster has a Husky refinery and an Archer Daniels Midland canola plant. The Weyerhaeuser pulp mill in Grande Prairie has a capacity of 390 thousand metric tons. The Peace Valley oriented strand board mill in Fort St. John can put out 820 million square feet annually. Bonnyville is near the Cold Lake military base, in the heart of pumpjack land. Image: Northern Property investor presentation, January 2015.

Alas, by the middle of 2015, vacancy rates at Northern's Alberta properties had doubled in six months and stood at 14 percent - a problem into which True North had also backed, when it took in 29 properties in Alberta and Ontario from Starlight at the end of May, 2014.

In June, oil prices began to sink, owing to the combination of Saudi determination to protect market share and American shale oil production - a technological disruption of the industry that has nullified most of the value of the last great technological advance, tar sands extraction.

For True North, having gotten itself into the same boat as Northern Properties, the stage was set for the courtship and eventual marriage of the two REITs, which occurred in August of 2015.

Northern "purchased" True North, a term whose meaning is unclear to me in the circumstances, along with one of the other entities that had emerged back in 2012 from the Trans Globe shuffle. The whole aggregation was renamed Northview.

When the arrangements were concluded, Northern Property CEO Todd Cook continued as CEO of Northview, and True North CEO Leslie Veiner became COO. Daniel Drimmer wound up holding 15 percent of Northview, making him the largest shareholder in a REIT with just under 25,000 apartment units whose "enterprise value" (a number that takes debt into consideration) was about three billion dollars.

August, 2015. Northern Property plus North Star becomes Northview, a regionally diversified apartment REIT, the third largest in the country.

You must be logged in to comment.

There are no upcoming events right now.

Why not post one?