The Iranian Oil Bourse threatens the historic role of the US dollar as the world's reserve currency.

By Rudo de Ruijter

Published February 15, 2006

In 2002, most journalists did not see what was behind the accusations that Iraq had WMDs. Today, most people do not know what is behind the accusations that Iran has plans for nuclear weapons.

Iran's threat is not nuclear, but far more dangerous to the US. If Iran can open its upcoming euro-based Oil Bourse in Tehran on March 20th 2006, Iran will threaten the US dollar.

Up to 1971, each US dollar represented a fixed amount of gold. During the Vietnam War, the US had printed and spent more money than their gold reserves allowed. President Nixon had to abandon the gold guarantee. Since then the dollar value is determined by the law of offer and demand on the exchange market.

Normally, the exchange rates between currencies reflect the health of their countries' trade balances. Countries that export more than they import will see their currency rise in value, and countries that buy more than they sell will see the value of their currency decrease.

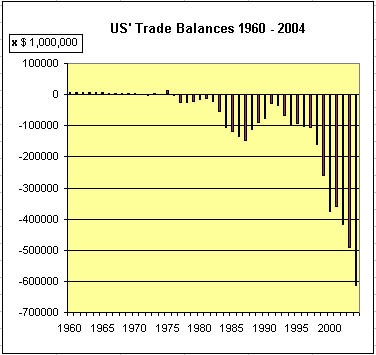

This is the case for all other currencies, but not for the US dollar. For 30 years the US has imported much more than it exported, and the trend is worsening. Normally, this should make the currency fall in value, but the dollar has not fallen. How is that possible?

The same year Nixon abandoned the gold standard, the Oil Producing and Exporting Countries (OPEC) agreed they would only accept US dollars in payment for their oil. This has a major advantage for the US: all other countries would have to buy dollars first before they can obtain oil. This creates a permanent demand for dollars.

Those foreign countries account for roughly 85 percent of the international oil trade. This is the part of the oil trade that takes place outside the US, between oil producing countries and foreign countries.

Call it the foreign oil trade dollar cycle: dollars are bought on the exchange market and spent in oil producing countries, which spend them in countries around the world. Those countries offer their dollar surplus on the exchange market and the cycle restarts.

Oil commerce always consumes more dollars. Global consumption increases, which raises demand for the dollar and allows the US to increase its production of dollars.

Since they are needed outside the US, they have to be made available abroad. This is where it becomes very interesting. There is only one way to get the new notes outside the US: spend them and do free shopping around the world. (These notes have only cost the paper and the ink.)

Of course, this creates a debt, for the foreigners could use these notes some day to buy goods, services, shares, buildings or land from the US. But since they are now needed in the always-growing money cycle for the oil trade, there is no need to worry about that.

This system works like a fairy credit card. Although the US has already much too much debt, suppliers cannot refuse to deliver goods, because they need the dollars for their oil purchases.

There are more sources of demand for dollars. Dollars disappear from the oil trade cycle for use in international trade between countries abroad. They form a huge amount of dollars that stays outside the US, only because of the preference of traders to use this currency.

Nearly the whole world needs dollars, so they are accepted nearly everywhere. Central banks, when they can, keep reserves in foreign money to protect their own currency. To explain it simply: if ever the money market would be glutted by their own currency, they could buy it back and offer the foreign currency in exchange.

These foreign banks traditionaly choose to build up their stategic reserves in the best accepted currency on the market: the US dollar.

For decades, the amount of dollars outside the US was generally growing. Each additional dollar abroad has meant it had to leave the US, the US has spent it abroad, and it has increased the US debt. Oceans of dollars are outside the US today. However, when traders lose their preference for the dollar, huge waves might overflow the exchange market and make the dollar drop.

The US Treasury, the Federal Reserve, has an efficient way to pull dollar surpluses away from the exchange market: it offers bonds with interest. It is a good way to control the rate of the dollar. Pull more dollars from the market to see the rate go up, and pull fewer dollars from the market to see the rate go down.

These loans cost interest. To pay for the interest the Fed issues new loans, which adds to the interest to be paid. As a spiral the annual amounts have gone up and continue to increase. The national debt is increasing explosively now, at over eight trillion dollars ($8,000,000,000,000). 45 percent is owed to foreign creditors. You have to be very optimistic to believe that this debt will ever be paid back.

The only difficulty for the Fed is to find enough foreigners to buy their bonds. Traditional buyers are growing more reluctant. Often these are foreign banks and companies, which already have invested a lot in dollars. They fear that if the dollar collapses, their investments will be worthless too.

To keep the dollar miracle going, the buyers still continue to buy bonds. If they are shortsighted, they will think they get interest. If they observe better, they will notice they have to buy additional bonds first and that the interest is paid with their own money.

Each year the US buys more goods than it sells. For the year 2004, the shortage on US commercial balance was six hundred and fifty billion dollars ($650,000,000,000), meaning that in average each US citizen enjoyed $3,000 more imported products than he or she earned.

Graphic of Trade Balances 1960 - 2004, made with data from http://www.census.gov/foreign-trade/statistics/historical/gands.txt

You can express it as "the average productivity is too low" or "the government spends too much money". For instance, on the high military cost to fulfil the neoconservative dream to rule the world. It will be an empire on credit, based on a strategy to keep the demand for dollars going, the dollar rate high enough, and Treasury Bonds attractive.

Of course, Iraq's destiny had already been sealed in the neo-conservatives' plans even before Bush Jr. entered the White House. In their eyes it is natural that the US should dominate the Middle East.

The US is world's biggest oil consumer (25 percent of global oil consumption) and most of world's oil reserves are in the Middle East: Saudi Arabia (26 percent), Iraq (11.5 percent), Kuwait (10 percent) and Iran (13 percent).

Iraq seemed already under control, as it had been paralysed since 1991 by the embargo. The UN and US had inspected the country during many years without finding anything suspicious. Sadam seemed already beaten.

However, he still had a trick. Since 1997, Iraq had been allowed to export oil in the Oil For Food program. In 2000 Sadam asked the UN to convert the account of the Oil For Food program from dollars into euros. The UN had no legal base to refuse it and from November 2000 Iraq sold its oil in euros.

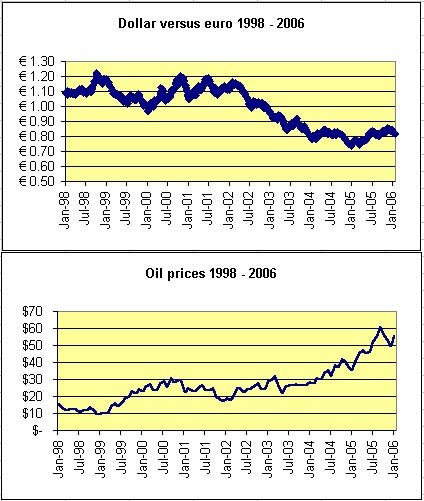

Graphic of Dollar rate versus euro from 1998 to 2006, made with data from http://fx.sauder.ubc.ca/data.html

As a result, the oil trade dollars became superfluous and overflowed the money exchange market. They were soon followed by 10 billion dollars from the Iraqi reserve fund, and the dollar rate went down. Seeing the dollar rate lowering, many operators in the rest of the world trade switched to the euro too, which lead to new waves of dollar offers on the exchange market and lowered the dollar rate further.

For the US it normally does not seem a big deal to absorb surpluses of dollars by issuing Treasury Bonds, as long as there are enough foreigners to buy them. Once the dollars are absorbed, offer and demand would be stabilized again.

Nevertheless, Iraq's switch to the euro reduced the market share for the permanent demand for dollars, and thus this reduced the upward force on the dollar rate.

When the world oil price would rise again, there would not be any extra dollar needed in the Iraqi oil trade. It would permanently limit America's free shopping. Most painful, the US had no unlimited access to Iraqi oil anymore. It had to buy euros to dispose of it.

In 2002 the fall of the dollar became more dramatic. The White House spread lies about WMDs and prepared to invade Iraq. Unfortunately the international community appeared to be reluctant. Meanwhile the dollar continued falling.

In March 2003, the US overruled the Security Council and attacked Iraq. On June 6, 2003 the Iraqi oil trade was switched back from euros to dollars. [10]

In spite of Iraq's switch back to dollars, the fall of the dollar merely halted. In the spring of 2003 Iran had started to sell their oil in euros too. (Iran had announced its intention already in 1999, but Sadam actually switched to the euro in November 2000).

Iran's move to the euro is logical if you realize that Iran sells 30 percent of its oil production to Europe and the rest mainly to India and China. The Iranian oil price was still labeled in US dollars, but customers did not have to exchange their money into dollars anymore.

From August 2003, the euro continued its march upwards and the dollar continued to go down. Again huge amounts of superfluous dollars from the oil trade overflowed the exchange market and had to be mopped up by issuing Treasury Bonds. However, this would not repair the needed permanent demand level.

It was not feasible to Invade Iran and turn the oil trade back into dollars, so a less popular method had to be used. The oil price should rise. This pumps the dollars into the oil trade again. For each extra dollar needed by the US, seven times more dollars are needed abroad (as 85 percent of the international oil trade takes place outside the US).

To make up for the loss of the Iranian trade the price increase had to be substantial. US' military spending needed extra credit, and thus extra oil price increases. The prayers of the treasury have been heard. Between July 2004 and September 2005, spot prices doubled. A few hurricanes helped US citizens, and the rest of the world's oil consumers, accept the new policy.

To see Iran in the euro-camp is not pleasant for the US. It creates a growing demand for euros. On the contrary, the market share for the permanent dollar demand becomes narrower and so does the acceptance of the dollar in international commerce. Between July 2004 and July 2005 the part of the dollar in world trade went down from 70 percent to 64 percent. A little bit less than half of those 64 percent represents America's part in world trade.

However, the biggest change has to come next month. On March 20, 2006, the Iranians want to start an oil bourse in Teheran, with prices in euros.

This can have big effects on the exchange rate between dollars and euros. If the oil price in euros gets lower than the oil price in dollars, there will be a rush on euros. And if it the oil price in euros gets higher than its price in dollars, there will be a rush on dollars.

So, basically Teheran gets an influence in the exchange rate of the currencies, which means risks for both the US and Europe. Today Teheran is pressured and threatened by both. Fluctuations in exchange rates might also bother China's exports to the US.

The New York based NYMEX and London based IPE would lose a lot of their power to set the world's oil prices. Normally, since Tehran's bourse has to be attractive for oil producers and oil consumers, it would not be logical to expect important differences in price with the dollar-based markets. Maybe just a bit lower, to build up a market share.

Each loss of market share of NYMEX and IPE is a big problem for the US, since it determines world's permanent demand for dollars. But the problem can also become much bigger. At the moment that other oil producing countries switch to the euro, there will be new waves of superfluous dollars on the exchange market, which take the dollar rate down.

For the US, mopping them up by issuing bonds will then hardly be possible, since traditional buyers and central banks will prefer to convert, as least partly, to the euro too.

Pumping the dollars back into the oil trade with rises in oil prices worked fine in 2004. But from March 2006 this way out can easily be blocked by stabel prices in Teheran. If prices in euros ramain stable, prices in dollars can hardly rise.

Prayers on the NYMEX and IPE market will be rather useless then. If the US loses its means to get superfluous dollars from the exchange market, the fall of the dollar would be a fact.

As by coincidence the Federal Reserve has decided that from March 23, 2006 they will not publish the M3 money aggregate anymore. To put it simply, they will keep secret how many dollars are held in non-American banks.

There are a lot of speculations about what would happen when the dollar falls. In my opinion it all depends on what will be left of the permanent demand for dollars. As long as the dollar rate is not based purely on US imports and exports, any scenario of changings will turn out to be temporary. I do not say these changings would not hurt, but in the end the US would still have its credit card and can continue to buy on tick.

Normally, when dollars become cheaper, American products and services become cheaper for foreigners. Instead of buying bonds, foreigners would increase their imports from the US. Simultaneously, foreign goods will become more expensive for the US. But once again, the US will profit from the oil trade. Oil producers will not accept a lower value for their barrils. If the dollar goes down 10 percent, their prices will "logically" rise 10 percent. (In this case the price converted to euros would remain the same.)

So this would mean that the permanent demand for dollars in the oil trade rises with 10 percent again. At some point of the fall, the upward force on the dollar rate will be back, the US treasury will mop up the dollar overflow and the US can continue to buy on tick again.

Outside the US many central banks detain enormous reserves of dollars and treasury bonds. These paper mountains would shrink in value. Many industries detain dollar denominated capital. In most cases their value will drop.

Many banks in the world hold dollar denominated assets. They will have troubles in meeting the obligations to their clients. These difficulties may lead to a cascade of bankrupts.

The essence of the problem is the fact you need a special currency to buy oil. As long as the world needs dollars to buy oil, the US makes abuse of the situation and buys on tick from the rest of the world.

The euro contains the same risks. As long as there would be a motor for a permanent demand for euros like, for instance, an euro denominated oil bourse in Tehran, the eurozone could make debts and let it increase indefinitely.

To avoid such debts, the eurozone would have to export the equivalent of all euros needed outside its borders and keep the same amount in foreign currencies in their central bank. Why would they? The credit trick worked fine for the US during more than 30 years!

When oil producing countries would sell oil in two or three different currencies, this simply means that the three involved countries can do the same trick as the US does now. In the long run it would multiply the problem by three.

The only solution for this problem would be that oil selling countries accept all currencies on the market. Tehran has already taken into consideration to accept more than one currency and not just the euro. Step by step.

For the outside world the diplomatic joust is about nukes, which seems more exciting. However, since 9/11 the whole world knows that rather inexpensive terrorist solutions are much more effective to do harm and that even a big arsenal of nukes does not offer any protection. We are asked to believe Iran did not notice that and still wants such old fashioned nukes.

William R. Clark, Petrodollar Warfare: Dollars, Euros and the Upcoming Iranian Oil Bourse, Media Monitors Network, August 5, 2005

Toni Straka, Killing the dollar in Iran, Asia Times, August 26, 2005

America's Foreign Owners , The Trumpet, Thursday, September 22, 2005

Krassimir Petrov, Ph. D., The Proposed Iranian Oil Bourse, 321 Gold, January 17, 2006

Martin Walker, Iran's really big weapon, United Press International, January 19, 2006

Webster Tarpley, Behind the Mad Rush to Bomb Iran, Pressbox, Jan 25 2006

Petroeuro, From Wikipedia, the free encyclopedia

Cóilín Nunan, Trading oil in euros - does it matter?, Energy Bulletin, January 30, 2006

By bert (anonymous) | Posted None at

Well done for covering this subject, which has been totally ignored by the mainstream meadia. The same threat of the collapse of US OilDollar hegemony was behind the invasion of Iraq - the article at http://www.ratical.org/ratville/CAH/RRiraqWar.html provides an in-depth analysis of the REAL reason for the Iraq War – to overturn Iraq's decision (in late 2000) to use the Euro to sell its oil (see http://archives.cnn.com/2000/WORLD/meast/10/30/iraq.un.euro.reut/ ) A further explanation was recently provided in this speech from Republican(!) Congressman Ron Paul of Texas , see here: http://www.house.gov/paul/congrec/congrec2006/cr021506.htm This subject needs publicizing far & wide.

Genius. You are one. But I'd hate to think what those in the know in the White House are planning for Iran once the currency war gets hold. Plan 8022 (I think thats its name anywho)is a unilateral air strike involving nukes deployed by the US in an emergency. No ground troops needed. Iran controls the oil and the Straight of Hormuz. I doubt the US can dig its way out of this with more impact creaters without WW3.

By What if (anonymous) | Posted September 06, 2006 at 14:09:09

Rudo

How do the Latin American countries and Russia fit into this? Isn’t Mexico and Venezuela the largest oil producers in this part of the world, don’t we import from them as their main consumers. Do they purchase in dollars?

Isn’t Russia’s the next biggest oil producer for our children’s generation? What are the possibilities that when China has the resources they won’t find the mother load of all oil pools? What tender type will they use in the near future 5 years from now (possible paperless)?

By To What if (anonymous) | Posted September 25, 2006 at 23:56:28

Venezuela is one of the OPEC founders. Although they had threaten to use other currencies for trading their oil, but from what I heard, they still use US Dollar.

At the end of 2005, 78.4% of the world proven crude oil produces came from OPEC countries. (source: http://www.opec.org/library/FAQs/PetrolIndustry/q1.htm)

So, the impact from other non-OPEC countries are irrelevant to the US Dollar. Although Russia produce the largest oil in the market, but they are not even the top 5 of the largest proven crude oil. All top 5 largest proven crude oil producer came from middle-east. Proven crude oil means that the crude oil is very high quality.

China would not give any impact to the US Dollar even if they found crude oil in their own backyard. Why ? Because they would need a large amount of oil produce to be able to be major oil producer and to therefore to give some impact to the US Dollar. To have a large amount of oil would require a large oil field or some numbers of oil field. To have an oil field found would take thousands and millions of dollars.

From what you have written is seems as if you are opposing the articles with baseless arguments.

By RK (anonymous) | Posted April 05, 2008 at 12:24:13

Fall of dollar is planned by Fed. The real thing is to control all natural resources of the world. US capitalists are planning a much bigger and dangerous game. World may see series of major wars in near future.

By Tufan Özge (anonymous) | Posted September 05, 2009 at 12:44:30

The US-Petrodollarsystem will collapse,because the national members of the OPEC will decide,that all Trade of Petroleum Related Products like Oil and also Gas will be traded in Euros and in NEW EUROS OF THE NEW WARSAW PACT.It is absolute neccessary to let collapse the US-Petrodollarsystem to maintain political and economically Stability in the Middle East and around the world.

All the nations of Asia will support the strategic efforts of Iran in the case for the abdondonment of the US-Petrodollarsystem in the favour of the Petroleum Trade in the old Euro and NEW-EURO SYSTEM.There is the possibility that the USA could react aggressive in the wake of this event and the USA could make other related accusations with the help of the US-Propaganda Media,but the USA should be reminded that a Military Conflict with Iran will result in the involvement of all asian nations,like the nations of the SHANGHAI COOPERATION ORGANIZATION (SCO)and other asian nations.There will be a additional GLOBAL RESERVE CURRENCY IN ASIA and this will be the ACOM CURRENCY OF ASIA and not only in Asia there will be a GLOBAL RESERVE CURRENCY,there will be also GLOBAL RESERVE CURRENCIES for other continental Organizations like the UNASUR=LATINO or SUCRE CURRENCY,the AFRICAN UNION=AFRICOM CURRENCY,the GOLF COOPERATION COUNCIL (GCC)=GOLD DINAR CURRENCY,the NEW EUROPEAN UNION=EURO CURRENCY OF THE NEW WARSAW PACT.

We will trade with each other continental Organization and we will exchange our national products and our national services without exchanging the US-Bully Currency.

The President of the Russian Federation Mr.Medvedev made the announcement more then

once in the past in the case for the introduction of the NEW GLOBAL RESERVE CURRENCY

of the ACOM CURRENCY on the WORLD STAGE and this will be the beginning for the Cooperation with other Continental Organizations like the UNASUR=LATIN or SUCRE CURRENCY,the AFRICAN UNION=AFRICOM CURRENCY,the GOLF COOPERATION COUNCIL (GCC)=

GOLD DINAR CURRENCY,the NEW EUROPEAN UNION=EURO CURRENCY OF THE NEW WARSAW PACT.

The Victory will be ours forever!

Tufan Özge

You must be logged in to comment.

There are no upcoming events right now.

Why not post one?